No President - American or Otherwise - Controls the Price of Petroleum

But there really is hope...and we now have a motivated opportunity.

Sorry, but War —> Uncertainty, Uncertainty = Risk —> Risk ++ Costs

Blame Vladimir Putin. He feels as if Ukraine rightfully belongs to the Russian Federation - a highly-questionable and historically-inaccurate assertion - and is willing to invade the country to take it.

Oil traders & brokers want a steady flow of oil, payment of futures contracts, and an easy sale on the back end of the deal. Traders hate risk to their steady supply lines. Russia pumps a lot of oil, oil fields and pipelines are sabotage targets, and war can disrupt supply lines (sabotage or not). I mean, think of the sanctions already in place…

So, to compensate for this risk, buyers have to pay a premium over what they’d pay in normal times. This is not so different from when your car insurance premium goes up after you add a teenager to your policy or you wreck your Camry. The insurance company - who pays your repair and liability bills - wants to be compensated for the added risk they’re now taking on.

Putin Isn’t Wholly to Blame

Sure, recent events have made oil prices go up more, but they were rising all throughout 2021, when the Ukraine was just a gleam in Putin’s Russian-nationalist eye. Why did they go up so much in 2021? Well, that isn’t hard to do when prices went way down in 2020 (see below) while the world was dealing with the ‘rona. We might call that a “rebound”.

Reasons why prices dropped in 2020:

Lots of people worked from home that didn’t before —> less automobile gas usage

Many fewer people traveled by air —> less aviation fuel usage (jets don’t use auto gas but it’s refined from the same raw material)

China pursued a “COVID Zero” policy and locked down cities and provinces on the regular, which not only cut down commuting but also cut down on businesses operating (this also impacts supply chains, BTW) —> less oil used for heating, industrial processing, etc.

I’m sure I’m missing other reasons

Reasons why prices have started to rise again:

Much of the world is now vaccinated and relaxing most pandemic-related policies —> demand for oil has gone up

Some countries haven’t yet ramped oil extraction and refinement back up - partially due to local COVID-19 policies or lack of staff (who never returned from a layoff, for example) —> supply of oil has gone down

Short version: People used a lot less oil in 2020 and, as vaccines rolled out and countries relaxed throughout 2021, they started driving and traveling more, more businesses opened, etc., and supply chains haven’t repaired themselves yet. It would’ve been remarkable for oil prices not to rise in 2021.

No, Joe Biden Had Nothing Whatsoever to Do with Any of This

Had Donald Trump been President and vaccines still rolled out in 2021, prices would have risen a lot. Again, see the definition at the top of this post. You’d see ol’ Donny on Twitter - he’d still be there since January 6th would’ve never happened - blaming price increases on Democrats or Mexicans, and somehow a border wall would have fixed it. No, it doesn’t make any sense.

Either way, the United States and its politicians are subject to the same forces everyone else in the world is. Who sits in the White House is going to change that very little. Sorry.

The USA is the New Saudi Arabia

OK, not exactly, but the USA is very close to being a regular net oil exporter, according to the US Energy Information Agency (EIA), so we’re not really at the mercy of the world…but our drillers sell their oil on the global market, too.

The USA started promoting renewing domestic drilling near the beginning of the Obama Administration, right after the price spike in 2008. We’ve been “Drill, Baby, Drill”-ing ever since, to the point that we’re now exporting oil, on net, from the USA for the first time in over 70 years.

In other words:

…except, like, minus the human-rights abuses, monarchy, and stuff.

There is No America-Only Oil Market

This is the reason why I said “on net” in the previous section. American oil drillers sell their product, via exchanges, to buyers, who then send it…places. Some stays in the USA, some not. The EIA tracks what comes in and what goes out, then does the math.

Key point that you should throw in anyone’s face if they happen to be making a really disingenuous argument about pipelines or drilling leases on federal lands or whatever:

It’s 100% true as of about the end of 2020.

But…

While we would now consider ourselves “energy self-sufficient”, we are not “energy independent”. The USA is not the USSR. We trade with the world. We do markets here, for better or worse, as does most of the world. As such, the USA’s oil market isn’t isolated from the world. The USA is part of the world market. Here’s a super-simple explanation of how this works:

Drilling companies (e.g.: British Petroleum [BP]) drill for crude oil, sell it to brokers (either directly or via an exchange) who want to turn around and sell it to refiners (often on the same exchanges). Refiners then sell their derivative products to company buyers (gas-station chains and operators, for example), who then distribute it for sale to you, the consumer, at the pump. It’s more complicated than this - and there isn’t just one value chain - but this is good enough for my purpose.

But look at that value chain. There are a lot of “pinch” or “choke” points, and any link in that chain can either be 100% domestic or cross international borders. Put the squeeze on any one of those steps and you’re going to see an increase in your cost at the pump. Examples:

There could be less raw crude oil reserves, reducing the supply

There could be fewer drillers, reducing the supply

A marketplace could fail (go out of business) or go temporarily offline (due to cyberattack or power outage), which disrupts the chain, decreasing supply

Distribution from the drillers to the refiners could be disrupted (broken pipeline or railroad, sunken tanker), decreasing supply

Distribution from the drillers to the refiners could become more dangerous (due to war, for example), increasing the cost of distribution

There could be more buyers of crude oil, increasing the demand

A refinery could go offline (remember that ransomware attack last fall that hit the Southeast?), reducing the supply

There could be more wholesale buyers (distributors) of refined oil products (gasoline, diesel, etc.), increasing the demand

There could be more retail buyers (consumers) of refined oil products (gasoline, diesel, propane, etc.), increasing the demand

Retail buyers (customers) could choose to drive more, increasing the demand

I’m sure I’m missing some failure modes, too.

These value chains usually cross geographic and/or political borders, and buyers around the world buy raw crude oil from…around the world…and those sellers have real-time access to prices…around the world, thanks to the Internet. These transactions typically go through a commodities exchange, two of which are based here in the USA:

The two most popular types [of crude oil] are Brent Crude and West Texas Intermediate (WTI), which are traded on the Intercontinental Exchange (ICE) and New York Mercantile Exchange (NYMEX) respectively. They are used as benchmarks for global oil prices, as well as economic health. [Boldface mine]

Thus, if someone - anyone - buys 100,000 barrels of Brent crude drilled from the North Sea, West Texas Crude from under…west Texas, or crude oil from the Bakken Shale in North Dakota, and that price is $100/barrel, you can bet that some other seller in, say, Frankfurt, is going to try to sell its oil to another buyer for…$100/barrel. If these prices become the going prices for a given day on a given exchange, that’s where “West Texas Crude oil closed at $100/barrel today…” comes from. Buy it or don’t at that price but, if you are a buyer for an oil refinery in the USA, you’re going to pay that price for your inputs or…you won’t refine oil. So, assuming you buy it, you price your end products to ensure a profit.

If you paid more for the eggs and flour, you’re going to charge more for the cake. Simple.

The USA Doesn’t Control American Oil Prices

It’d be nice if a President or other high-ranking official within the USA could flip a switch on or off but, as with anything in life, it’s not that simple. Also, do you really want the price of oil to be a plaything of politicians?!?!?!?

Either way, the USA used to control the price of oil. Sort of. The prices were “controlled” during the Nixon Administration (along with other prices) and had a regulated history for 4 decades prior to that. Of course, price controls have downsides - usually shortages or misalignment of resources - and Congress and the Carter Administration knew it in the 1970s. As many older readers will know, the Carter Administration went on a deregulation spree in the mid- to late 1970s and oil prices were not spared. No, Ronald Reagan did not do much of said deregulation (though he did some). Multiple laws to try to reform the regulations were passed, with the Energy Policy and Conservation Act of 1975 being the enabling act that finally helped the Carter and Reagan Administrations remove oil-price regulations:

Using power granted under the 1975 [Energy Policy and Conservation Act], President Jimmy Carter, in 1979, began to repeal price controls on oil through a series of administrative actions. President Ronald Reagan finished the job in 1981.

A good (though from a biased, libertarian source) explainer on oil-price deregulation steps out the timeline rather nicely. Interestingly, libertarians love Jimmy Carter in retrospect. Here’s an article from Reason, which is a libertarian think tank.

The UK regulates its oil & gas prices to some extent, but there were stories (here and here) over the last week about their prices going way up, too. Here’s an article from late 2021 about prices increasing globally.

So, the price you see at your local Speedway, Wawa, SuperAmerica, Fred Meyer, Costco, or Tom Thumb gas station is going up…but it’s going up at BP, Shell, or Total stations all over London, Paris, Amsterdam, and Berlin, too.

All This Said, The Price of Gas Matters Much Less Than Everyone Thinks It Does

I know everyone sees the prices staring them in the face when they drive and does this:

But…

…anyone who keeps a family budget knows how much they spend on gas each month. And while it’s distressing to see that budget have to rise…the increase is very likely a pretty small chunk of your family budget or post-tax income.

Yes, there are unconventional cases. I know a guy that drives 30,000 miles per year for work. Just humor me.

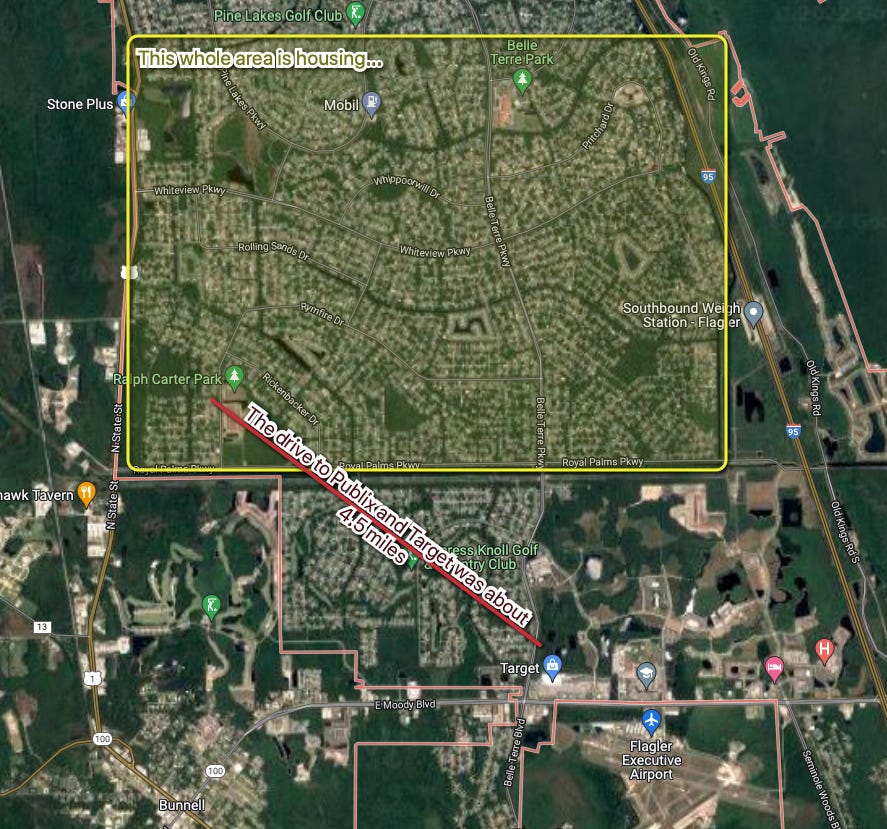

A personal example for you. From mid-2005 until we left in early 2013, we lived in Palm Coast, Florida. This city is situated halfway between Daytona Beach and St. Augustine in northeast Florida. Throughout this period, either I or both my wife and I worked at or near the Daytona Beach airport (DAB), which was ~30 miles south, down I-95.

We didn’t make a ton of money combined during any year of this period. I was an operations & program manager for Embry-Riddle Aeronautical University the whole time. My salary was between $38-45K. My wife was a teacher for the local school district for the first half of our time in Palm Coast, then went part-time as an adjunct professor at ERAU and Daytona State College for the latter half. Despite both of us having full-time jobs and having some side hustles, I think the most we ever made in a year, pre-tax, was just north of $90K (I think 2008?). We both worked in education, so neither of us was banking much.

Additionally, for most of our time in Palm Coast, our schedules didn’t match nicely, so we couldn’t always carpool. So, we both had to drive to work. Add in the fact that everything in Palm Coast is very spread out, we had to drive a lot in town as well.

We were routinely driving, combined, about 20,000 miles per year, averaging around 25 mpg between our two cars (a Ford Freestyle and Ford Focus SE).

During the oil-price spike in late 2008 (local prices were about $4.15/gallon), our monthly gas budget for both cars was $450. Definitely not fun…but not exactly a mortgage payment. When prices crashed early the next year (local prices were about $1.75/gallon), the monthly budget dropped to about $200. That entire difference - from cheap to expensive - was $3,000 for the year. That’s not nothing, but it’s also not making or breaking much of anyone.

To illustrate this a little more clearly, I mapped $ per gallon against miles per gallon to show the annual fuel-only cost for a car that drives 10,000 miles:

It’s not unreasonable for most modern cars to get 30-35 mpg. In that case, your annual difference between gas at $1.50/gal and $5.00/gal is…$1,167. That’s pretty underwhelming. But even if you’re running around town, rolling coal in a 2022 Ford Super Duty pickup truck (retail price ~$40,000) getting 10 mpg while weaving in and out of traffic, the difference between gas at $1.50/gal and $5.00/gal is…$3,500. Again, not nothing, but it’s hardly an existential threat to anyone’s finances, especially if you’re driving a $40,000 truck…

It’s just really annoying.

American Presidents Have the Power to Persuade…and Make Policy for the Future

In the end, the President of the USA doesn’t control gas prices but s/he sure can set some policies that can affect it in the short- and long-term. Some examples:

SUPPLY SIDE:

SHORT TERM: The President could negotiate with other world leaders to coordinate the release of a bunch of barrels of oil from countries’ strategic reserves in reaction to Russian invasion and resulting market dislocation.

MEDIUM TERM: Congress and the President could open more lands for oil exploration & drilling

DEMAND SIDE:

MEDIUM TERM: The President could set higher fuel-efficiency standards, clean-power supports, or emissions targets

As an aside, go test-drive an electric vehicle if you haven’t before. They’re pretty sweet. Gas-powered vehicles feel downright sluggish by comparison.

MEDIUM TERM: Congress and the President could work to subsidize clean-power technologies, both in supply (research, exploration, production) and demand (rebates for EV purchases, for example)

LONG TERM: Congress and the President could enact laws and regulations (preferably the former) that would reduce Americans’ exposure to oil-price shocks by greatly reducing our need for oil overall. The Carter Administration did this by phasing out oil-powered power plants, for example.

There are a lot of other options here that would push the price downward.

The Way Out

The most-sustainable options to reduce oil prices are on the aggregate demand side: Move as much American transportation and electricity generation away from oil-derived fuels as possible. For example, we could scale up existing wind farms:

Or we could continue to incentivize - at the federal and state levels - the purchase of electric vehicles, such as this bad boy :) :

NOTE: We bought a plug-in hybrid not long ago - which is only a partial EV - and got $6,750 back in state and federal rebates. Something like a Tesla will get you closer to $10,000 here in Oregon.

You could also go a lot cheaper:

We could build lots of solar farms in sunny places, like one proposed near this area in south-central Oregon (which is basically the Nevada desert):

Or we could go all-in with a solar, wind, and storage all-in-one facility, such as the Wheatridge Renewable Energy Facility, by Portland General Electric here in Oregon:

If we do all of this, Vladimir Putin can be as crazy as he’d like but we could then intervene on our terms and not have to consider the impacts to Americans’ wallets nearly as much. It’s the smart thing to do.