Yeah, those weren’t the Prince lyrics. Whatever. If the shoe fits, wear it.

I’m back. I felt like writing. Work is busy and has been for a couple of years (big, big project) and I have to use my brain a lot. But…I’d like to use my brain for something else. Why the heck not? Also, subscribe. I don’t write all that much but I like to think what I do write is fun to read. I also don’t intend to put this stuff behind a paywall.

Interest Rates & You

Alright, the pandemic is long over. Everything reopened really quickly in 2022, which put a bunch of strain on our supply chains and left many of our businesses really short-staffed. This meant that the costs of what supplies we did have - in terms of goods and labor - went up (inflation). This meant higher wages for many of you (yay!) but also higher costs for things like cars, lumber, etc. (boo!). You may have been feeling like this guy:

Of course, one way the US Federal Reserve Bank - a.k.a. “the Fed” - fights inflation is by raising interest rates on loans they issue, and those higher rates filter down into other bank loans - ones issued to businesses and, well, you. If you’ve been searching for a house to buy over the past couple of years, you’re well aware of this. This is done to limit the amount of new money hitting the system (fewer new loans, etc.).

Wanna know what else these interest rates filter down to, though? US “Treasuries” - a.k.a. “savings bonds” - or bonds that the US Treasury Department issues to pay for stuff like highways, military jets, and…existing debt (yes, we have a budget problem). Why does that matter? Well, banks tend to keep these around as low-risk investments and the US government pays out interest on them. Where does the bank get the money to buy them, though?

You.

Huh? Why on Earth would you give the bank money to buy Treasuries so they can get a low-risk stream of sweet, sweet cash? Cuz you want to make some low-risk money, and you’d like the bank to do the hard work of actually investing. You do this all the time - it’s called a “savings account”. You give money to the bank, they take some of that money and buy some Treasuries, they collect some interest on those Treasuries, then they cut you in on some of the profits and keep the rest for themselves:

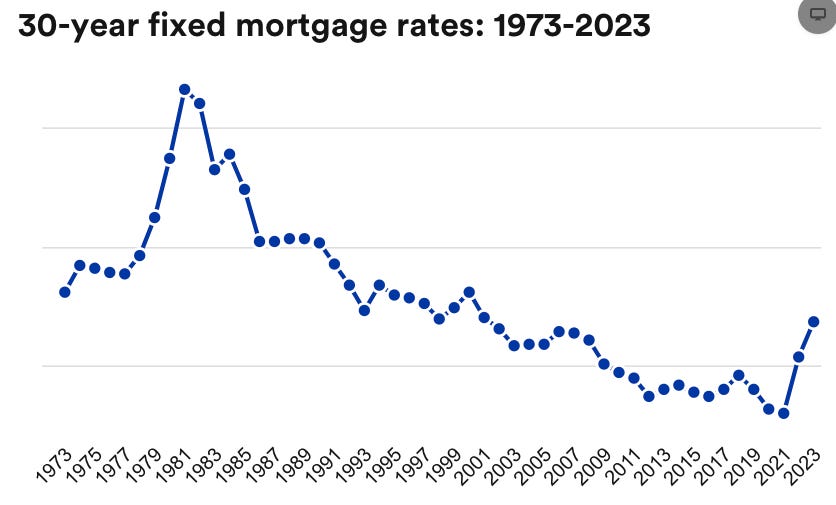

But we’ve lost our muscle memory for this as Americans - heck, probably as Canadians, too. For the last, oh, 15-ish years, interest rates - for loans and savings accounts - have been quite low. Many of you that were lucky to have bought a house between 2010-2021 may have mortgages in the 3-4% range. Why? Hardly any inflation to speak of that entire time, so low interest rates. Today’s 30-year mortgage rates at what they were in roughly 2004-5.

That’s likely why you’re chuckling to yourself and saying, “yeah, OK, my savings account is paying 0.25% right now. I earned like $8 in interest last year”. And you may be correct! Your account today is, in fact, paying that much if you weren’t paying attention. Banks weren’t getting beans for interest on Treasuries for years, so your cut of those profits was a measly few bucks. However, due to the higher inflation - and the Fed raising interest rates to fight it (successfully, I might add) - of 2021-2022, those Treasuries are paying out higher interest payments, and that means that some banks are bringing back accounts that pay some God’s-honest interest. What’s old is new again.

We’re partying like it’s 1989. So, what’re you gonna do about it?

If you haven’t done this yet - and a conversation I had this weekend tells me that even many of you who pay close attention to such things haven’t thought about it at all lately - you really need to get on board. There’s free money sitting out there for the taking. All you have to do is open an account, transfer in the cash, and check your statement every month. If you really wanna get geeky, take advantage of some certificates of deposit (CDs) for a little more money, usually from the same bank (restrictions apply - read the fine-ish print).

Seriously, people. Do it. Stick it to the man.

Yes, it Really Is This Simple - I Shall Show You

You can just type “high-yield savings account” into Google and get some ideas:

Scroll through the page a bit and get some ideas…but, honestly, a savings account is a savings account. You might choose one bank over another for a variety of reasons - ease of the user interface, familiar company, customer service, you already bank with them otherwise, etc. - but the product is truly a lot the same.

Signing up is generally quite easy and from the two I’ve tried, using them is also quite easy. We use Marcus by Goldman Sachs. Honestly, I really like it. Super easy. I’m sure they’re helpful, if needed, but I’ve never spoken to anyone there.

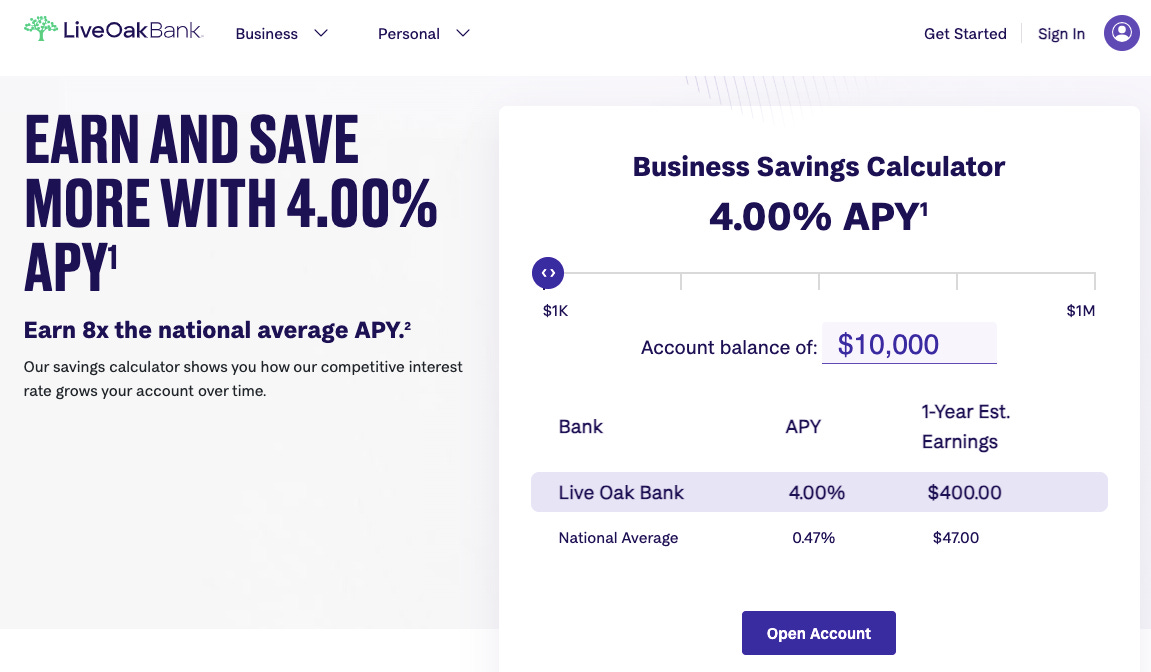

For those of you with a small business, there are even some business high-yield savings accounts out there (though fewer). Our homeowners’ association (I’m the treasurer) uses Live Oak Bank for our reserve funds.

Just go do it, people.

But WHYYYYYYY, Jeff???

Because it’s free money! Your savings account, if you’re doing it correctly, just has money sitting there with nothing to do. So, make it get off its butt and make more money! Let’s say you have $10K in savings (if you only have $5K, cut the numbers below in half) and it’s currently getting 0.50% APR - check your Wells Fargo or US Bank account and you might find that this is exactly what you’re getting. If this is the case, you’re only gonna make $50 this year. HUH?!?!?!? If you were to open an account getting around 5.00%, however - and there are plenty between 4.50-5.25% here - that immediately jumps to $500, a gain of $450 for the year. And then there’s compound interest, where each year builds on the previous. I put together a handy little table for y’all.

Put $10K into a 5.00% APR savings account and let it ride for 5 years and you have $12,155. That’s $2,155 for doing absolutely nothing.

Now, you’re gonna get taxed on those earnings - you get taxed for the small interest payments now, likely - but even if your income has each additional dollar in a 25% marginal tax bracket, you’re keeping about $1,600 of that. Again, for absolutely nothing.

And That’s It!

I don’t think I need to write anything else to get my point across. This is like taking candy from a baby, y’all. Do it. Now. You’ll thank me.