We Keep Taking Back Our Abusive Ex - Stick it to Putin by Decreasing Demand for Oil, Part 1 of 3

The USA has a toxic relationship with oil, and addressing only the supply side of this problem just enables it.

“I’m addicted to you. Don’t you know that you’re toxic?”

Before You Start

I wrote about gas prices last weekend. If you want to learn more about how the oil market basically works, start there. I also had a rather popular Twitter thread around it:

A Little Demand Reduction Goes a Long Way

First:

So we could, at the very least, reduce our demand such that every drop of oil we’ll need for years could come from under American soil.

Additionally, reducing your oil usage really isn’t that tough for most people and, honestly, even a 5-10% decrease in American demand is huge on a global scale. We use a ton of oil. But even small reductions in demand can have an effect on prices.

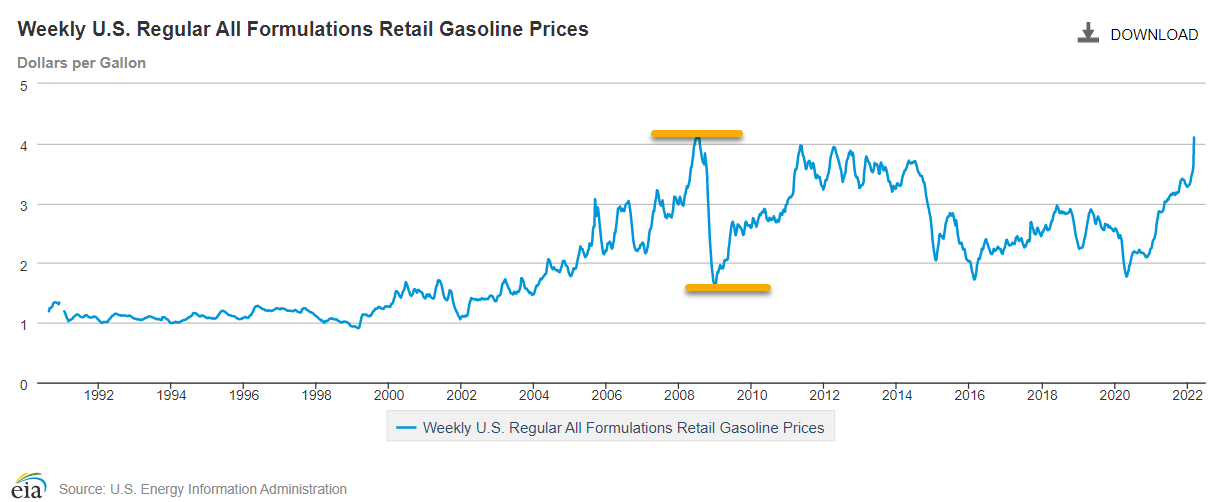

I mean, from June to December 2008, US demand dropped maybe ~10% due to a pending recession. Yes, there was a worldwide recession that hit some places harder than others…but prices dropped from $4.08/gal in late June 2008 to $1.61 in late December 2008. These price levels are fragile:

Now, if you could make that demand reduction permanent and reduce it steadily more over time…that’d be kinda cool, no?

Americans Feel Entitled to Cheap Gas

This quote in a news story from the AP pretty much sums up my frustration:

David Custer, a Virginia resident who was paying $60 to fill up his SUV before Tuesday’s announcement, said Biden should undo executive actions he issued to protect the environment upon taking office and instead promote U.S. “energy independence.”

Boldface mine. You’re driving a SUV and it takes 15-20 gallons of gas. Maybe the problem isn’t the price…but your demand?

But regarding his “energy independence” statement, I first suggest that you give this episode of Vox’s “The Weeds” podcast a listen for more details:

But even if you just look at purely US supply vs. demand…

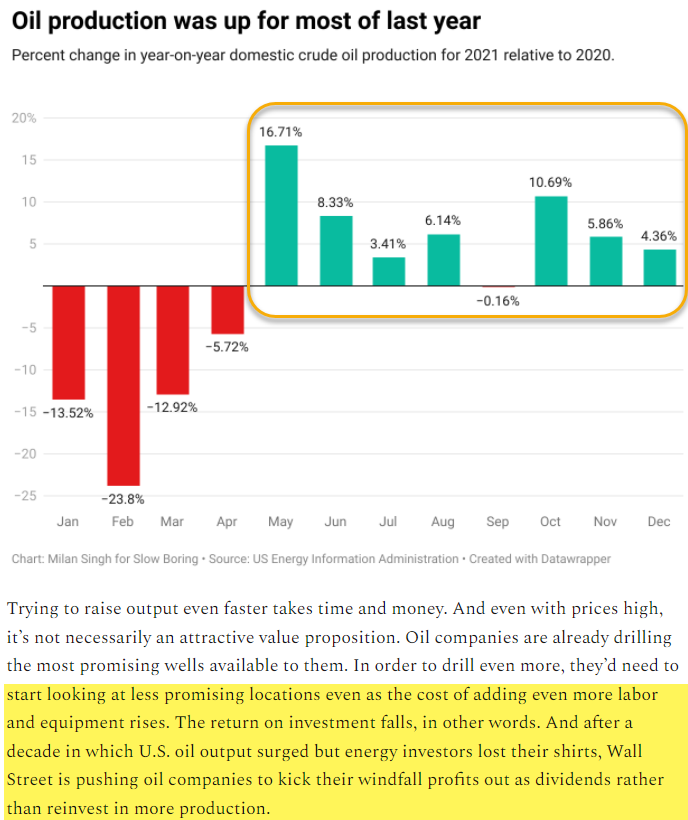

In this sense, we are “independent”, dude. Well, self-sufficient, but same diff. Not only that, the USA’s output is up over the last year by a fair amount, so this is just factually incorrect. The problem of more drilling is that lots of the drilling companies…kinda don’t wanna do it (this is from Slow Boring, which is paywalled):

American drillers took it completely on the chin over the last decade and their market values tanked as a result. Their corporate overlords are saying more drilling isn’t necessarily a good business strategy. And since American Presidents can’t just turn a dial and make the drilling rigs go brrrrrrrrrr, this is where we are.

Regardless, Just Admit It - Making Vladimir Putin & His Cronies Richer Feels A Little Dirty

First, to reiterate the above:

But…if you fill up a gas tank, you’re increasing demand for oil overall. If you increase demand, you put upward pressure on prices. If prices of oil go up, Vlad gets more money. Why?

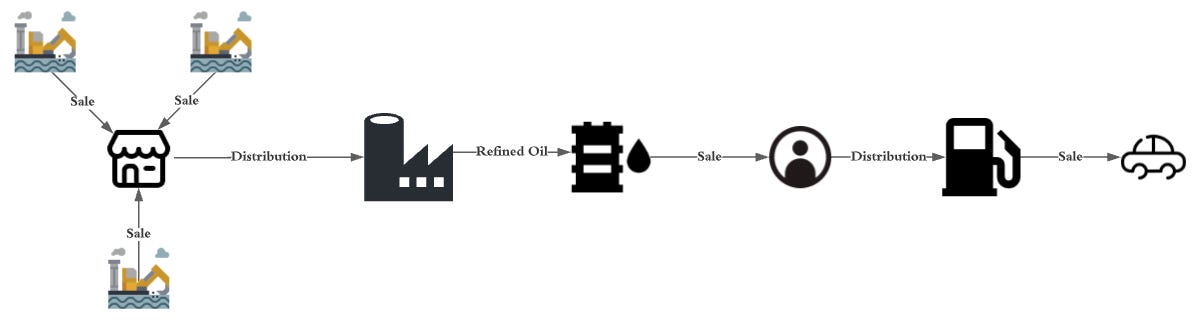

Crude oil is a commodity bought and sold on the open market (same as wheat, corn, etc):

As I said in my previous article:

[B]uyers around the world buy raw crude oil from…around the world…and those sellers have real-time access to prices…around the world, thanks to the Internet.

Your increased demand means the USA needs more oil, which raises the price of a barrel of oil that is sold on the world marketplace, and Russia sells its oil…on the world marketplace. So when oil prices go up here, American oil producers count their cash…

…but prices also go up there, and Russian oil producers count their cash…and Vlad and his oligarchs get paaaaaaiiiiiiiddddddddddd.

It’s an Elementary Exercise

Indulge me in a simple explainer of supply and demand. We see this in the food market - filet mignon, truffles, specialty wines & cheeses - all the time. We just don’t apply it to oil, for some reason.

Let’s say I have exactly one apple tree. As you know, fruit trees have good and bad years. So, if in a given year my apple tree produces very little fruit, some of my buyers will be willing to pay more for an apple just to make sure they get what they want or need. The scarce apples will go to the highest bidders - those that need their apples - and those that couldn’t afford them or didn’t feel like shelling out that sweet cash will buy pears or oranges instead (or nothing). Each apple sells for a high price.

But if the apple tree is raining fruit and I have the same number of buyers, I may still sell all of the apples (yay!) because each buyer bought more than one…but each apple will fetch a lot less money (boo!), meaning the price of an apple fell:

“Yeah, Jeff, this is simple enough. But this assumes more buyers don’t show up.”

I agree. So, let’s say word gets out that I have cheap apples. Thus, the next time I have a sale, twice as many people show up for the same number of apples. What happens? What you’d expect. The price of each apple goes back up.

In the two cases of high apple prices, the reasons differed. In the first case, there was product scarcity. In the second case, there was a demand surge. Thus, there are two ways to make prices go up:

Decrease your supply

Increase your demand

Conversely, we can make prices go down by:

Increasing supply (grow more apples)

Decreasing demand (knock off some people, sell from a covert location, divert their attention to to a substitute product, etc)

Now imagine the apples are barrels of oil and the people are buyers of oil. Done.

The USA Has Increased Oil Production A Lot and Increased Consumption A Little

So, back to oil.

In the last 13 years or so (ignore the pandemic, as that was an anomaly) - basically since the start of the first Obama Administration - the USA has more than doubled its oil production. In that same period, American consumption increased only about 10%:

Interestingly, the USA is using less oil per day today than we did in 2008. Who said we can’t cut back??? We’re already doing it.

But…But…But…Then Why Are Gas Prices High?

Because oil is drilled, sold, and used around the world. There are international markets for this stuff. Again, read my last.

American politicians don’t control oil prices, and the American market isn’t the end-all for oil. There’s a great big world out there! And…they drive, too. If you’ve never been to Sweden, Norway, Canada, Japan, France…Rwanda…Sierra Leone…you’d be surprised to find out they drive cars and trucks that run on oil products. So, the USA could literally disappear and there’d still be an oil market, and the prices would fluctuate based on supply & demand of the remaining 7.4 billion people on this rock.

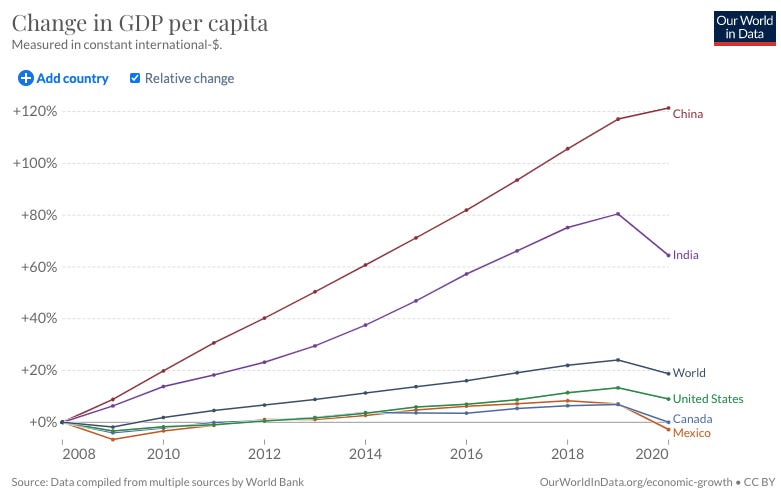

Another key piece: Since 2008, the world’s two largest two countries - China and India - have gotten a lot richer (in GDP per capita) as compared to the rest of the world, and especially as compared to any of the NAFTA (er, USMCA) countries.

As they got richer, more of their citizen bought cars, got better jobs in places farther from home, thus they used more oil, etc. This is all before we even factor in North American growth! So, while the United States has closed the gap between domestic supply and domestic demand (we export now!), the world ramped up its demand, bringing supply & demand together at a higher price than would otherwise be the case.

The USA producing a bunch of oil is great for the companies drilling and refining the oil (or maybe not…), but if global supply and global demand dictate a higher price - due to higher demand or lower supply on Earth - then American oil prices will reflect this global price. After all, ExxonMobil and Texaco don’t just drill for and sell their oil in the USA. They sell their oil, from wherever they got it, to the highest bidder on the commodities exchange, and that person may very well be in London. Or Dubai. Or Shanghai. This transaction, performed thousands of times a day on exchanges and marketplaces all over the world, sets the price of oil. Free markets, baby.

Russia’s National Budget is, like Alaska’s, Tied to the Price of Oil

No, really. From Reuters last year:

The Russian Finance Ministry had initially projected an oil price, of $45 per barrel when compiling the budget for 2021. The price has instead averaged $69.

If you can make the price of oil go down, you can hit ol’ Vlad in the pocketbook.

Russia Uses Oil & Gas Sales to Keep the Ruble’s Value Up

Same Reuters article goes on to say, about its trade (current account) surplus:

Russia ran a historically-high current account surplus of $120.3 billion, equal to 7% of gross domestic product, last year, driven by high gas prices.

That current-account surplus is literally dollars or euros in the bank for Russia - foreign currency it can use to support the ruble and keep it from taking a nosedive. Russia, through central-banking policy, puts the dollars & euros its companies collect from international oil sales into a piggy bank that can be used to buy rubles at a later date, increasing its value, allowing Russians to buy goods not produced in Russia (such as German automobiles), which then allows not-Russians to buy more Russian oil…etc.

So if we want to decrease Russian influence on the world, buy less of their oil, man.

Embargoing Russian Oil Hurts Russia…but it Hurts the Globe, Too

A rather blunt way of decreasing demand for Russian oil is to…just ban the purchase of it. That’s what’s happening right now in the USA. It’s a justifiable response to an unjustified action…

…but that’s a rather abrupt cut to an oil supply, which causes prices to jump. It’s also typically temporary. Decent chance that some American and foreign, non-Russian companies will be able to increase production to replace some of the supply in the short-term. However, that still leaves us in a place that’s vulnerable to supply shocks (though maybe not Russian ones). So, there will eventually need to be a better way to insulate ourselves from high oil prices.

“Drill, Baby, Drill” Isn’t an Energy Plan

Sounds great, right? Regardless, you can blame Michael Steele, who was the Republican National Committee (RNC) Chairman during the 2008 election season. He came up with the slogan, which became a chant at their convention.

While it is not, in fact, an energy policy, which former MN Governor Tim Pawlenty pointed out in 2009…

…the USA’s oil companies actually took Michael’s advice (probably not) and started drilling like crazy in 2009…and, over the next decade-plus, the USA became the world’s largest oil producer.

No, really.

You’d think that, 13 years on, we’d be all set to go on our own. However, we’re not.

Truthfully, I don’t fault people for thinking more oil —> lower prices. It makes logical sense if your frame of reference is high-school microeconomics (which is as far as a lot of us went in this subject, including yours truly). If we produce more than 2x as much oil in the USA as before, prices should come down in the USA, right?

Nope.

We’re not looking outside our borders, and that’s the problem. Thus, more drilling in the USA won’t make much of a dent in the problem. There’s a whole world out there that acts just like we do here, and their demand affects the price of our supply.

So…chill, baby, chill. But then what should we do? Read Part 2 to see how we can move forward…and how you can make a difference.

I have exciting news to share: You can now read Clarity in the new Substack app for iPhone.

With the app, you’ll have a dedicated Inbox for my Substack and any others you subscribe to. New posts will never get lost in your email filters, or stuck in spam. Longer posts will never cut-off by your email app. Comments and rich media will all work seamlessly. Overall, it’s a big upgrade to the reading experience.

The Substack app is currently available for iOS. If you don’t have an Apple device, you can join the Android waitlist here.